We guide you through the legal steps of registering your company, ensuring seamless compliance with local regulations. From SECP to chamber registrations, we handle it all. Start your business legally with confidence.

Our expert tax advisory services help businesses navigate the complexities of Pakistan’s tax laws. We offer strategic advice to minimize liabilities and optimize tax benefits. Let us help you make informed financial decisions.

We simplify the process of registering for sales and income taxes. Our experts ensure that your business is fully compliant with tax authorities, saving you time and hassle. Stay ahead with proper tax registration.

Secure your brand identity with our trademark registration service. We handle all the legal intricacies, ensuring that your intellectual property is protected. Safeguard your brand’s future with professional assistance.

We specialize in preparing and filing accurate tax returns that maximize benefits while ensuring compliance. Avoid errors and penalties with our expert guidance. Trust us to simplify the process for you.

Registering with the Lahore Chamber of Commerce boosts your business credibility. We ensure a smooth and quick process, helping your business gain recognition. Open new doors to growth with us by your side.

Expand your business globally with Weboc registration, making import-export operations smoother. We guide you through the customs process, ensuring compliance and ease of trade. Unlock international opportunities with ease.

Our professional bookkeeping services keep your financial records accurate and organized. We help you manage cash flow, monitor expenses, and prepare for audits. Let us handle the numbers while you grow your business.

We provide comprehensive corporate tax solutions that optimize your company’s financial standing. Our strategies ensure compliance while minimizing tax liabilities. Let us take the stress out of corporate tax management.

We offer personalized tax services that cater to individual needs, ensuring tax savings and compliance. From filing returns to strategic planning, we’ve got you covered. Simplify your personal taxes with our expert help.

Stay on top of your sales tax obligations with our dedicated services. We ensure accurate filings and help you stay compliant with ever-changing regulations. Avoid penalties and streamline your tax operations with ease.

Our corporate tax planning services ensure your business is tax-efficient, compliant, and growth-ready. We analyze every aspect to craft strategies that minimize liabilities. Make tax planning an integral part of your success.

We handle tax audits with precision, ensuring all aspects are in order for a smooth audit process. Our experts prepare and file your tax returns to ensure accuracy and compliance. Let us safeguard your business from potential risks.

Ensure compliance with transfer pricing laws while optimizing tax efficiency. Our comprehensive studies and tailored recommendations help you meet regulatory requirements. We align your pricing with global standards.

We represent you before tax authorities and appellate tribunals, ensuring that your case is professionally handled. Our experts negotiate favorable outcomes and protect your interests. Let us be your voice in legal matters.

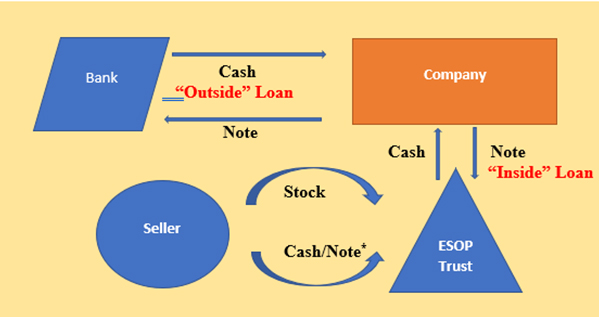

We design tax-efficient Employee Stock Ownership Plans (ESOPs) and succession strategies to maximize benefits. Our approach ensures long-term growth for both employees and businesses. Plan for the future with tax-smart investments.

We offer detailed tax reviews for mergers and de-mergers, ensuring compliance and strategic tax advantages. Our experts minimize risks and help you achieve a smooth transition. Make informed decisions during corporate restructuring.